Investing in Wine: Opportunities in a Calmer Market

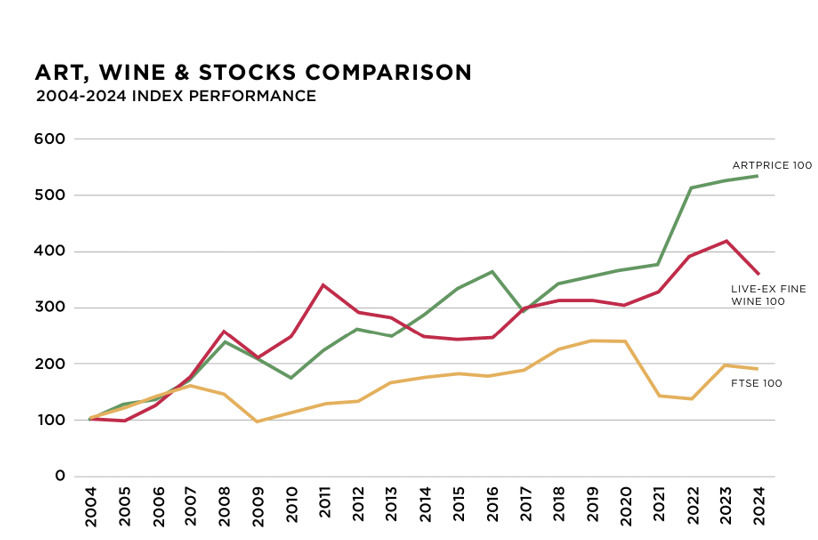

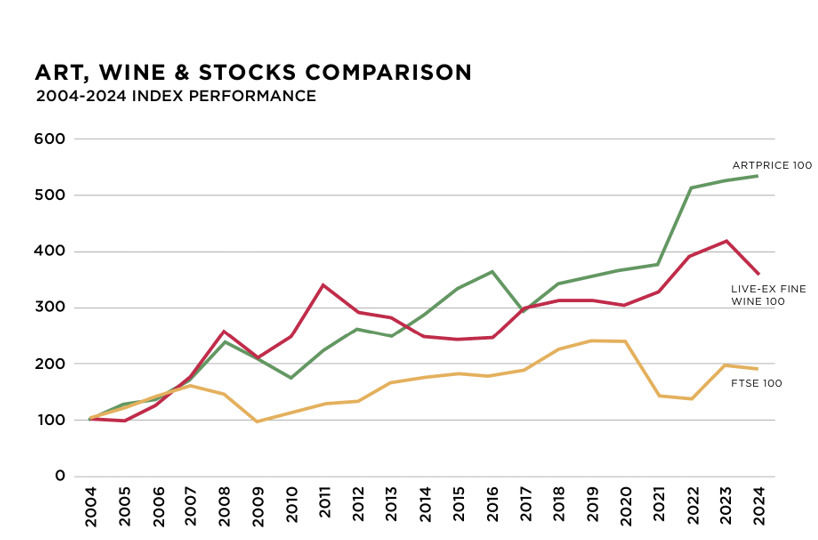

Investing in wine rarely begins with euphoria. On the contrary, the most interesting entry points often feel slightly uncomfortable. That is exactly where we find ourselves today. The fine wine market has become calmer and more cautious — and precisely for that reason, more attractive to investors with a long-term perspective. Recent developments in the global fine wine market show a clear correction over several consecutive quarters. This is not the result of structural issues related to quality or demand, but rather a combination of macroeconomic factors, currency movements and a generally more cautious investment climate. Historically, these are the phases in which markets gradually move toward the lower end of a cycle.

A Buyer's Market, Not a Panic Market

What we are witnessing today is not a collapsing market, but a classic buyer's market. Supply is available, sellers have become more realistic and buyers are taking their time. Transactions are taking place again, but selectively. As a result, price levels feel considerably more comfortable than they did a few years ago. For wine investors, this primarily means freedom of choice. There is no need to buy everything. Selection can be based on quality, provenance, reputation and liquidity. Not every wine represents an opportunity today — but some investment cases are fundamentally sound.

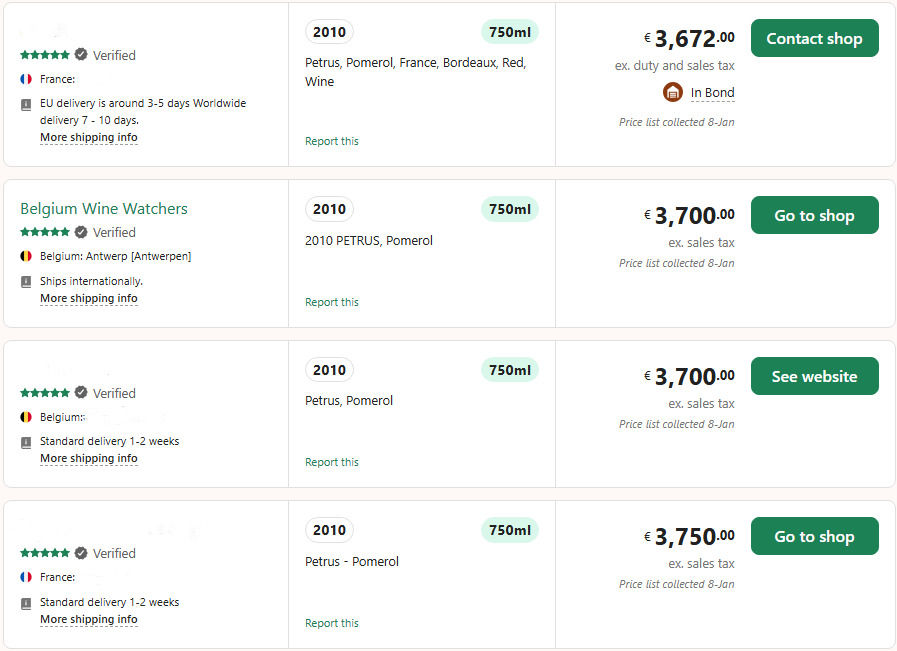

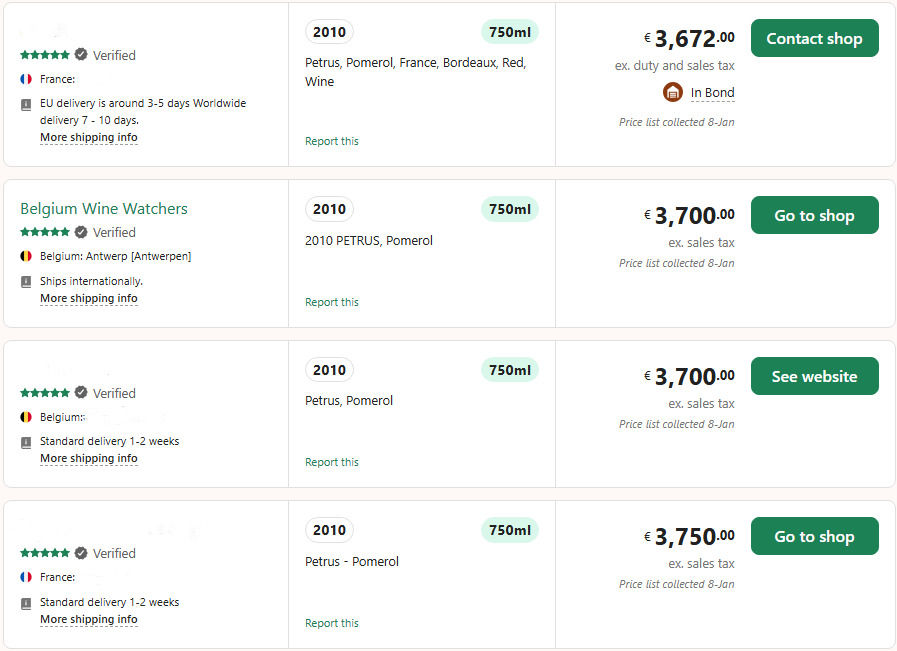

Our Prices Reflect the Market

At Belgium Wine Watchers, transparency is central to our approach. Our pricing does not attempt to outsmart the market, but rather follows its movements. In a correcting market, this sometimes means adjusting prices, sometimes holding firm — without artificial discounts or retrospective narratives. Our conviction is simple: investing today should be done at prices that make sense within the current market context. Not based on former peaks, but on where the market stands today.

Investing with Both Emotion and Realism

Wine is not a spreadsheet. It is a tangible asset with emotional value — but also with rules. Experienced investors know one thing for certain:

• You never buy at the absolute lowest price • You never sell at the absolute highest price • But you buy and sell at a price that feels comfortable

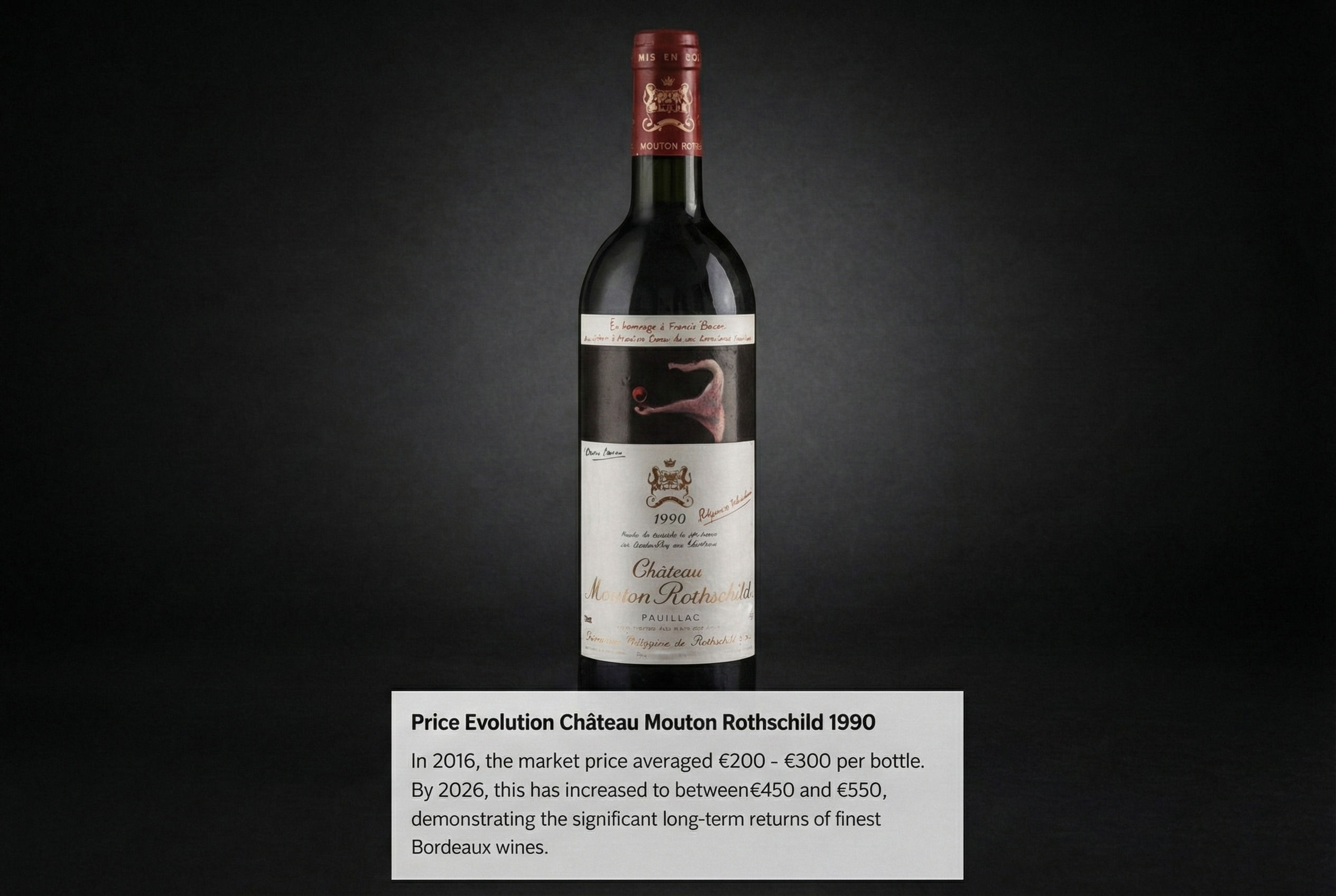

That comfort comes from experience, knowledge and trust in the product — supported by more than 20 years of proprietary market data. We allow ourselves to speak from intuition, but that intuition is never disconnected from numbers, historical price movements and market cycles we have been tracking for decades. This means not following every trend and not buying into every story, but investing in wines that have proven themselves historically, qualitatively and commercially.Success Stories Are Built in Silence

The strongest returns in wine investment rarely look spectacular on day one. They often begin in quiet years, when no one is in a hurry. A few cases of top Bordeaux left to rest. An iconic Burgundy purchased shortly after a correction. Champagne given time. In hindsight, these decisions appear obvious. At the time, they were simply rational choices — made without noise.

What the Market Is Telling Us Today

The current market sends a clear message:

• prices have corrected compared to previous highs • trading activity remains present, but selective • international interest is cautiously returning • volatility remains lower than in traditional financial markets

For investors, this is not a warning sign, but an indication of stabilisation. And stabilisation often forms the foundation for the next phase.Conclusion: Investing in Wine with Conviction

Investing in wine requires no bravado, but patience, discipline and conviction. It also demands honesty — about risks, timing and expectations. At the same time, wine remains a scarce, tangible asset with global appeal. Today may not be the moment of headlines and records. But it is a moment when quality is once again priced correctly. And that is precisely where we feel comfortable as investors. — Belgium Wine Watchers